Simple accounting for your short-term rental

Everything you need to manage the finances and taxes for your vacation rental.

Everything you need to manage the finances and taxes for your vacation rental.

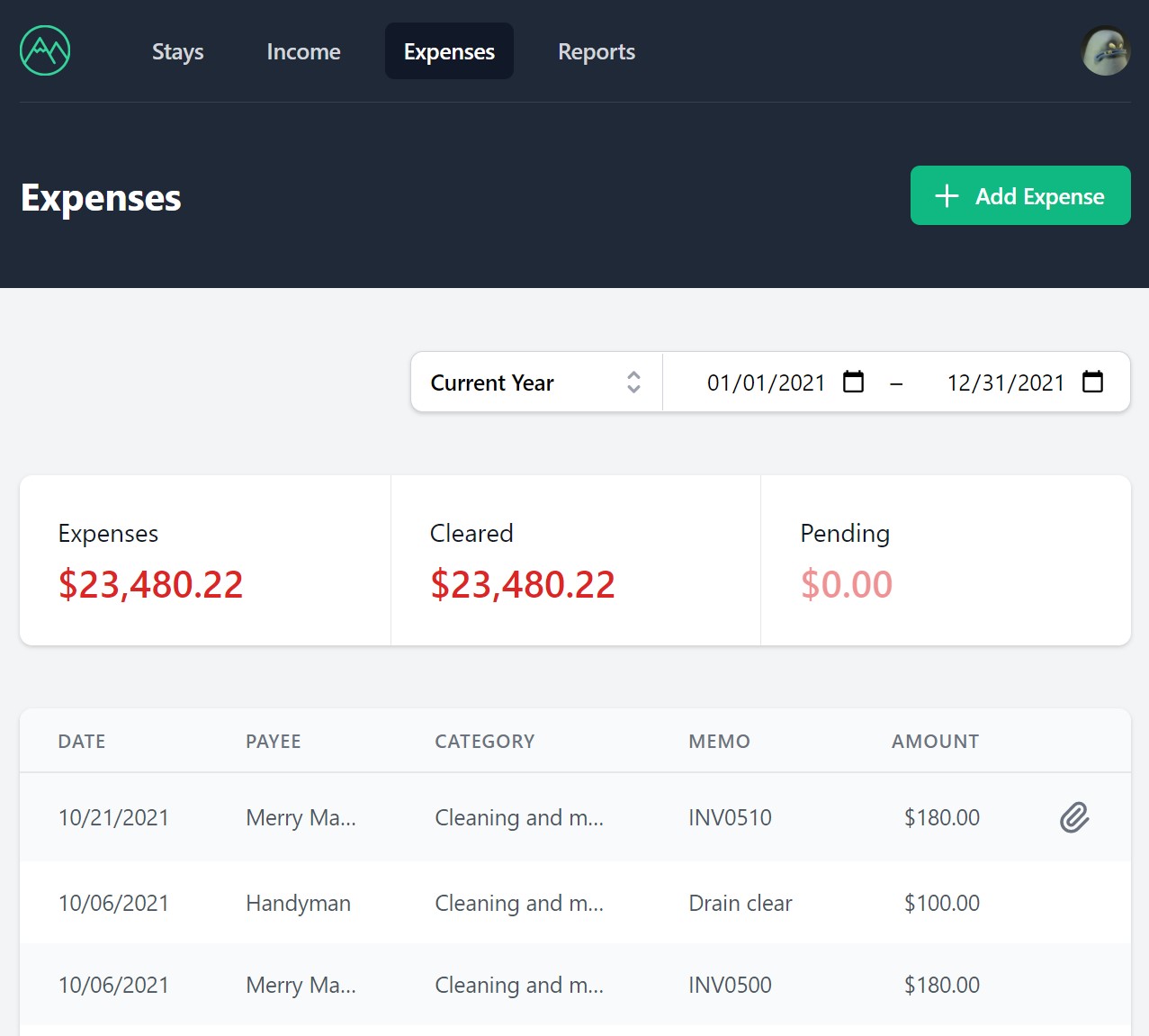

Are you maximizing your tax deductions? Many owners fail to track all their expenses, especially mileage deductions.

“It's important to treat your rental as a business, but the accounting can be overwhelming. Amodomo makes it easy enough that I can handle everything myself in about 15 minutes each week.”

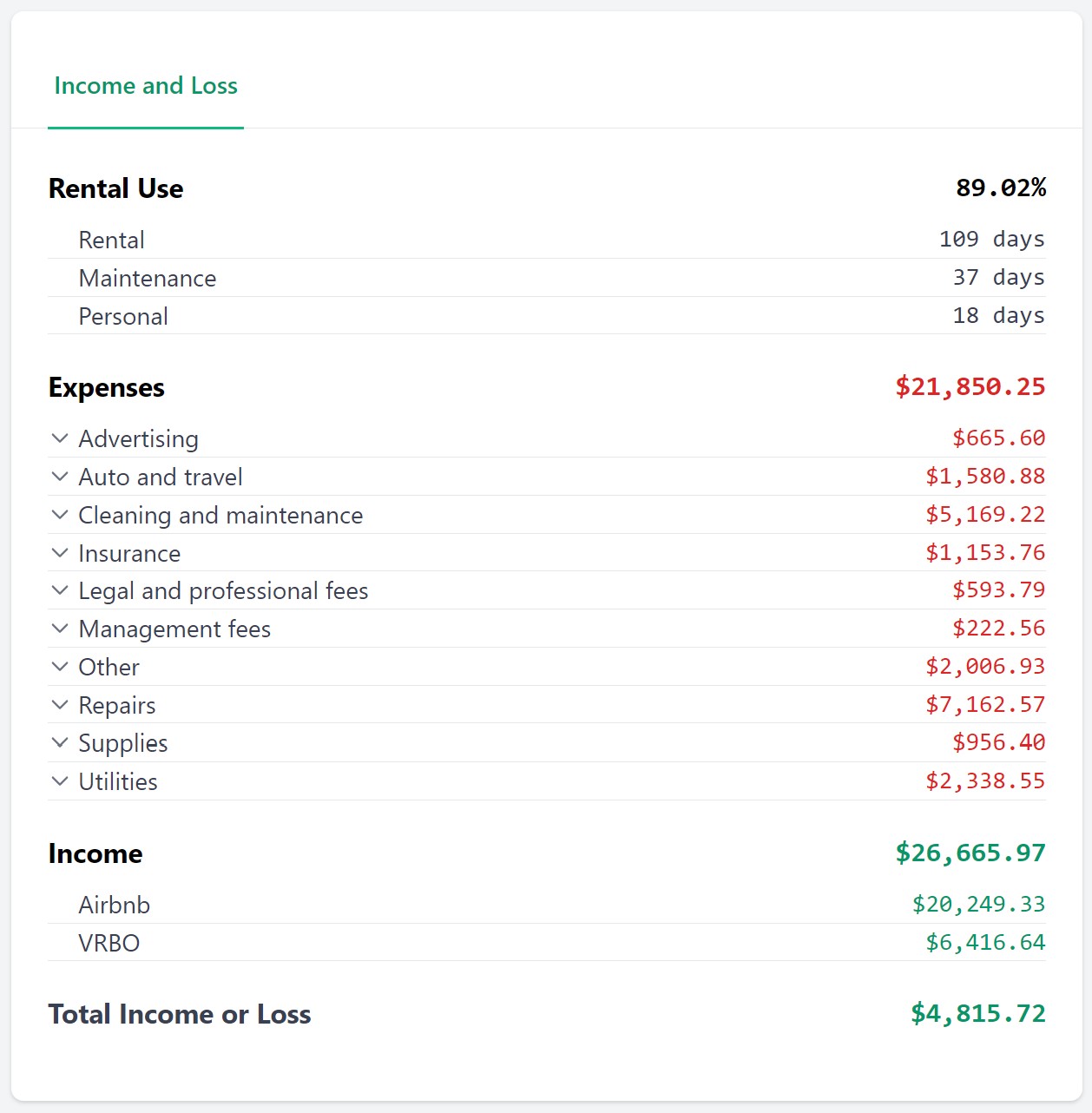

End-of-year reports provide everything you need to fill out your Schedule E or Schedule C, including the calculation of shared expenses for personal use.

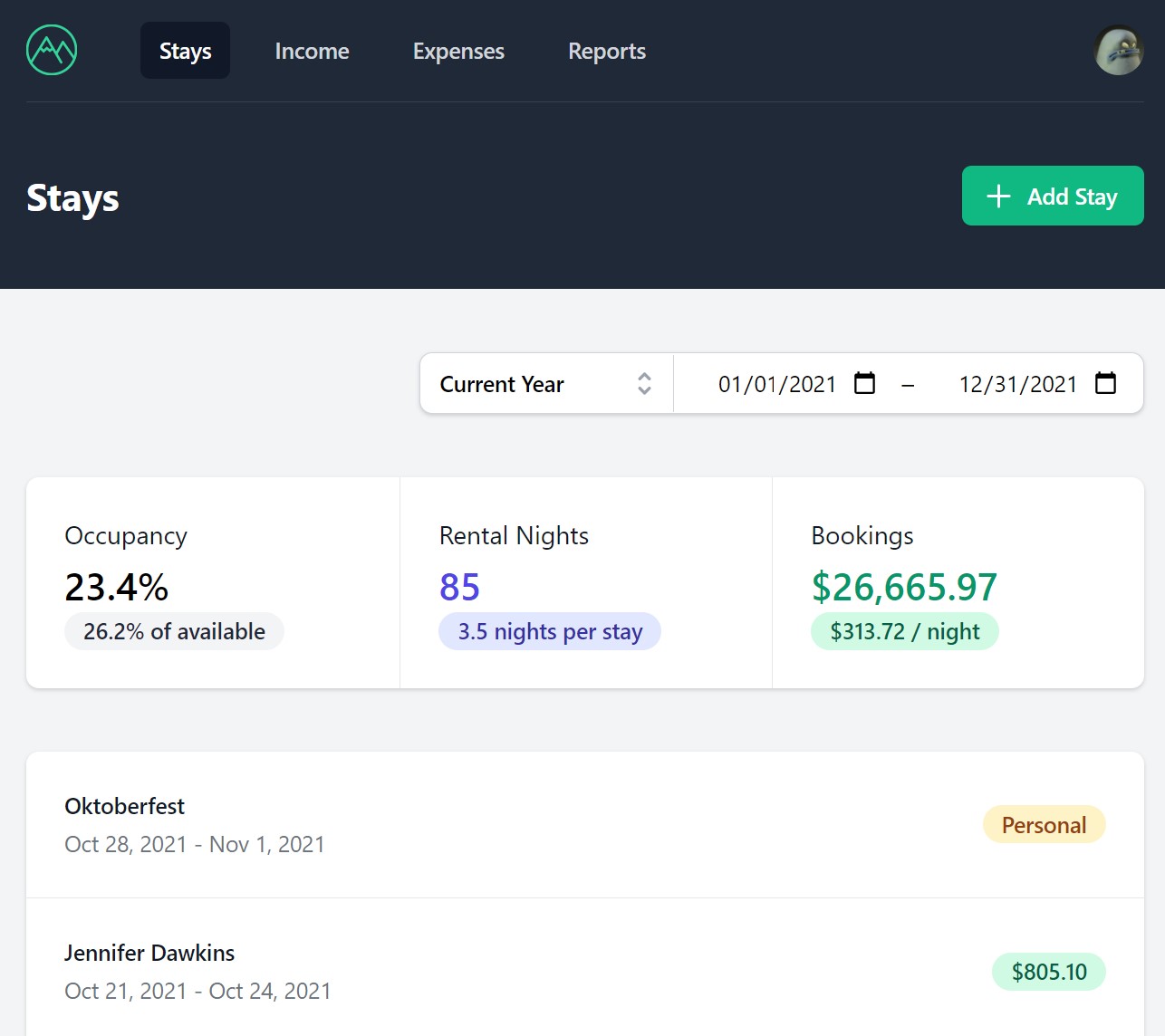

You need to know the details of how your rental is being used, for tax purposes but also to optimize your property's income. For example:

Free 30 day trial with no credit card required. If you decide to purchase, we offer a single annual plan with no contracts - cancel whenever.